HELLO TAXPAYERS

If you have any query related to Taxation Issues , You can directly write to us … or Call Us 8700418920 You will receive a call from our tax expert within one or two days

As a Taxation Advisory firm, we aim at guiding you throughout your tax compliance. Taxation is a specialised area and requires great skill and accuracy. Our expert tax consultants have the requisite knowledge to carry out tax planning, administration, documentation and representation.

Why Do You Need a Tax Consultant ? The primary role of a tax consultant or a tax advisor is to help people and organizations in paying their taxes. They hold expertise in tax law, tax compliance, and tax planning. Both individuals and business owners can hire a tax consultant for long and short-term tax optimization. They help in making tax returns and work closely with their clients to minimize their tax liabilities throughout the year. Hiring one doesn’t cost much and can help you pay only the required tax and avoid any tax liabilities at the end of the financial year.

How Do Tax Consultants Work ? Tax consultants know all about tax regulations under the Income Tax Act of India that individuals and businesses must abide by when filing their taxes. You can seek advice from a tax consultant over the phone or meet in person to file your income tax correctly. Apart from tax filing a tax consultant in India also offers assistance for the following:

- Tax documentation

- Filing e-returns

- Tax filing for freelancers

- Evaluating a tax payer’s legal and financial circumstances to determine his/her tax liabilities

- Completing tax forms like Form 16, Form12 B, etc. and submit them on the Income-tax website and send it to the Bangalore office

- Help you make legitimate investments like life/term insurance, health insurance, pension plans, child plans, and other tax-saving schemes by the government

What is the Difference Between a Tax Consultant and an Accountant ? The role of an accountant generally involves maintaining annual accounts of firms as well as filing their tax returns, analyzing business performance reports, tax audits, and providing general tax advice. They also advise reducing a company’s tax obligations. Simply put, their role involves making strategic financial decisions. Tax consultants hold a strong knowledge about the Income-tax laws and can offer you legal tax advice.

But make sure that he/she is either running a tax advisory firm or is a practitioner of tax-related issues before you consult one. He should also hold a certificate of practice. They can help you in tax planning throughout the year and not just before the end of the financial year.

Therefore an accountant performs all-encompassing roles whereas a tax consultant specializes in tax norms. Some accountant can also give you tax advice and help you in budgeting but hiring a tax consultant makes more sense as he would hold a comprehensive knowledge.

What is Better a Tax Consultant or a Tax Software ? Recently, tax software has become quite popular as they offer both ease and convenience. As a result, a number of Indians are able to file their taxes on their own. But software is not a replacement for a tax consultant with whom you can speak over phone, meet in person, and seek financial advice round the year. You can’t have a face to face discussion and do financial planning or even manage your investment portfolio. Tax software cannot ensure you peace of mind that you have filed your taxes correctly.

Whereas a tax consultant can help you make the right financial decisions and stay worry-free. There are numerable tax strategies which can help bring down your tax liability. You, however, need to look for them. A strong tax planning can help you gain immense tax benefits. It helps in saving your maximum possible income. The saved income can then be directed to various investment avenues which not only provide you good returns but also ensure that your financial goals are fulfilled. Such an effective tax planning in India requires expert income tax consultants and we provide you with such expert tax planning strategies. Our tax experts design comprehensive, strategic, and effective tax planning centered around your finance and goals so that you can enjoy maximum tax benefits through our online tax advice.

With the help of a tax consultant, you can easily identify your potential tax deductions in a year and advise you how to make strategic investments to avoid any tax-liabilities in the future. A good tax consultant can advise you effective methods to save on taxes in the most legitimate manner and improvise your financial portfolio. For instance, if you hire a tax consultant in India, he would identify significant tax deductions from your account, and help you save hundreds or thousands of rupees by filing your tax return, in return for a small fee.

Saves Time : Most of us end up filing taxed at the end of the year. And end up making investment decisions hastily. It takes a lot of time and effort to ensure that your income tax return is filed correctly. So a tax consultant would dig up your financial portfolio and double-check all your income and savings before you can start file your income tax returns. They can also suggest you to effectively manage your financial portfolio.

Its Safe and Hassle-free : It is always better to seek an expert’s advice when in doubt, especially regarding your finances. A tax consultant can maintain your tax records in the safest and legal manner without the need of you running from pillar to post.

He/She is also your Tax-Advisor : Even if you do not hire a tax consultant he can still offer you some tax advice. You seek updates from him when needed and do the leg work yourself.

In a Nutshell : As you can see a tax consultant can solve all the financial queries that would otherwise be holding you back from making right financial/investment decisions. Whether you are an individual or run a business you can hire a tax consultant to help you in tax planning and compliance.

Welcome to your most trust worthy and concerned tax consultants – Team Tax Advisor

Income Tax Filing

Get your business the right guidance and build a better strategy to save over 20% taxes on your business income.

GST Filing and Compliances

Leave all your GST related compliances on iTax. We will take care of monthly, quarterly or yearly filing plus cross-checking of GST vendor and client accounts. We will also guide you with best practices related to GST.

Income Tax Returns/Refunds

Have filed wrong returns? It is not easy to get refunds without technical know-how and expertise. With 20 years, we promise you that your money will be in your account.

Balance Sheet /Audit

Accounting and profit-loss is a major part of any business. We dedicate an account manager to you who will handle end to end accountancy. Plus, we ensure your books are audited by a qualified CA and filed timely to the ROC and income tax department

Every tax problem has a solution. Get a consultation today & gain peace of mind. Our team of expert professionals comes with 15 + years of experience.

Advocate Poonam Malhotra

Our core values embrace operating to the highest professional standards and building supportive and strong relationships with clients. These values are communicated throughout the firm and serve to instil in all our lawyers, a full appreciation of the professional and ethical responsibilities the firm places upon them.

Poonam Malhotra has a fantastic record as a first lady Tax Advocate of Panipat, Haryana and one of North India’s leading Tax lawyers and is a distinguished authority within the market. Besides being a renowned Tax Advocate , she is a researcher, and founder of an NGO – Mom & Me Foundation working for nursing mothers .

Tax Advisor is one of the prominent Taxation Consultant & Advisor firms in India. Our aim is to provide clear, concise and practical advice based on an in-depth knowledge of the legal, regulatory and commercial safe & clear environment.

A taxation lawyer will be able to defend you if a tax authority accuses you of under-reporting your taxes, and if you are in violation of any tax law not intentionally . Please contact to get opinion on direct and indirect taxation law, tax liabilities of Capital Gains, GST matters and Income Tax Appellate Tribunal (ITAT) appeals.

Rules of Bar Council of India & Indian Law does not permit law firms to develop a regular website. This is only a resource center aimed at providing information regarding corporate and legal taxation matters.

Our blended firm began in the early 2006 with a pencil and one girl’s dedication to prepare tax returns for her friends, families and neighbours. Back then, our staffs went door to door with pencils and paper, sat down in the kitchen, drank coffee and carefully, dutifully took care of each of her dear clients. Today, Tax Advisors invests heavily in adopting the most advanced technologies. Although we are confident that we have state of the art technologies, we have not moved far from our compassion and dedication to our clients. We still keep a pencil and a cup of coffee handy. We are a Team of Qualified Advocates and Certified Financial Planners with 15 years diversified business experience operating as your Certified Tax Advisors with a specialty in taxation preparation and planning.

Our Team provides business and personal income tax preparation services for Indian citizens throughout and outside India. A professional tax preparer can save you money by finding credits and deductions you qualify for, while simultaneously helping you comply with state and central tax regulations.

Our tax planning services are designed to help you, your family, and your business utilize the tax code more effectively. The purpose of tax planning is to mitigate your tax liabilities while developing a tax-efficient financial strategy for retirement and making investments too.

Come experience our personal Tax Planning services once and we promise you would never look back!!

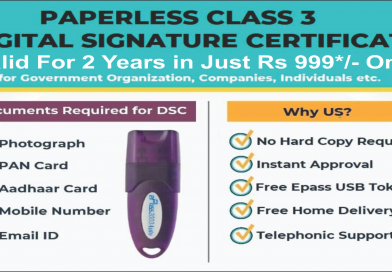

Expertise in GST Registration | GST Return Filing | GST Online Classes | GEM Registration | Income Tax Return Filing | Income Tax Refunds | Appeals | Trade Mark Registration | Trust Registration | Digital Signatures | GST Consultants | Income Tax Consultants | Tax Consultants|

GST Registration Queries

Our Team will Provide your GST Registration within 7 Days. Complete Online Process Have a query? Call us on 8700418920 for a complete free consultation regarding all of your GST Registration.

GST Return Filing Queries

Our Team will file your GST Returns within 24 hours. Complete Online Process Have a query? Call us on 8700418920 for a complete free consultation regarding all of your GST Return Filing queries.

Income Tax - Filing till Assessment

Preparation and filing of Income Tax Returns Replying to notices from department and Co-ordination with department. Representation before Tax Authorities. Appeals at Tribunal and Courts.

We are one of the best tax planners in India and you would not be disappointed. We promise to provide you with one of a kind tax planning management services for your finances complete with certified tax planners.

TAX Advisor

Tax Advisor is one of the prominent Taxation Consultant & Advisor firms in India. Our aim is to provide clear, concise and practical advice based on an in-depth knowledge of the legal, regulatory and commercial environment within which our clients operate and a full understanding of their overall business objectives. Our core values embrace operating to the highest professional standards and building supportive and strong relationships with clients. These values are communicated throughout the firm and serve to instill in all our lawyers, a full appreciation of the professional and ethical responsibilities the firm places upon them.