VIRTUAL OFFICE

Get trained by GST Expert on GST Filing and Registration ; Basic to Advance Course

Get trained by GST Expert on GST Filing and Registration ; Basic to Advance Course

This Basic to Advance GST Practitioner Certification and Practical Training Reveals All Secrets To Scale Your GST Career Without Spending Thousands Of Rupees On Coaches And Mentors.

Hosted By : Advocate Poonam Malhotra

First Lady Tax Practitioner Of Panipat &

Founder of Tax Advisor

Panipat | Ghaziabad | Chandigarh

Advocate POONAM MALHOTRA

Module A

Taxation and GST Basics

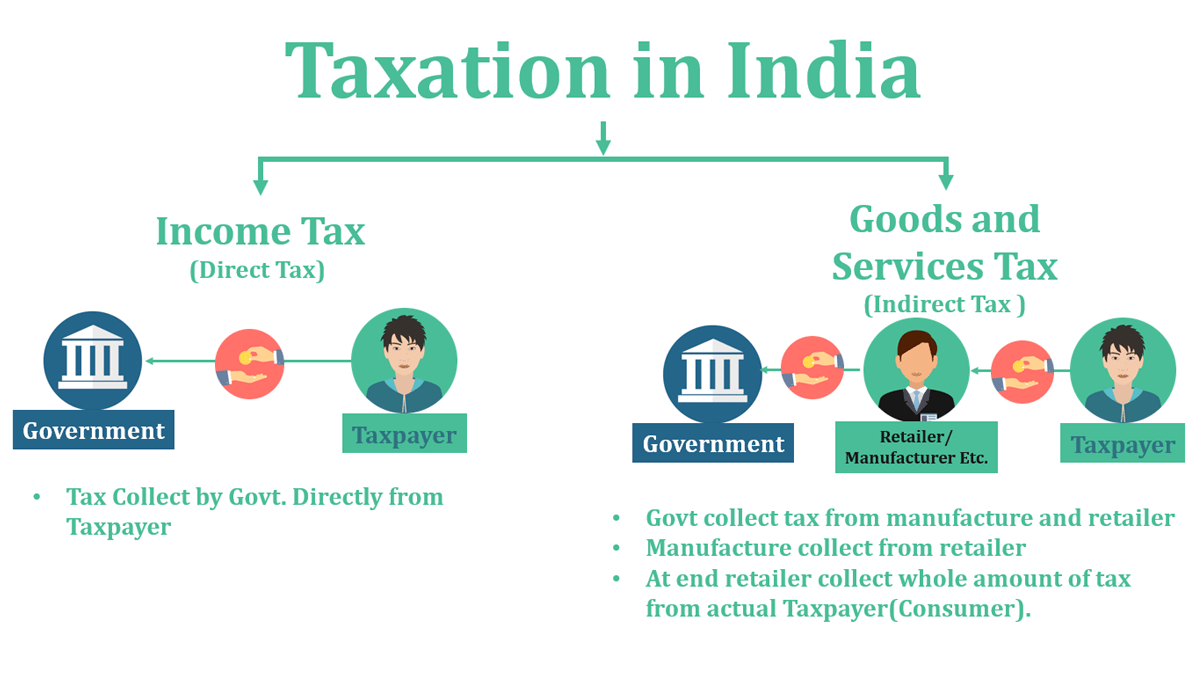

What is Tax, What is Direct and Indirect Tax, What is GST, GST History, GST Challenges, GST Benefits, Drawbacks of GST, Why GST, Types of GST Models, Destination Consumption and Origin-based GST, GST Model

Module B

GST Concepts and Basics

Dual GST Model, IGST Method, GST Terms, GST Rate, Input Tax Credit, Electronic Ledger, GST Input Tax Credit (ITC), Reverse Charge, GST supply, GST Value of Supply, GST Time of Supply, GST Place of Supply, GST Compliance Rating

Module C

Registration

GSTIN, GST Registration Form, Liable for GST Registration, Casual Registration, Non-Resident Person, Compulsory GST Registration, Voluntary Registration, Amendment to GST Registration, GSTIN Cancellation and Revocation.

Module D

GST Invoicing

GST Tax Invoice, GST Invoice Types & Formats , GST supplementary and Revised Invoices, GST Invoicing Time Limits, Changing GST Invoice, GST Invoice Signing, Good Transport Agency (GTA), Goods Transportation without invoice.

Module E

Returns

GST Return, GST Returns Types, How to File GST Returns, GST Outward Supplies Return GSTR – 1, GST Inward Supplies Return GSTR – 2, GST , GSTR – 9 Return, GSTR – 10 Return, GST Dashboard, Return Filing on GSTN

Module F

Input Tax Credit

What is input tax credit? ITC Entitlement Conditions, Utilization of GST ITC, Other ITC Scenario, CENVAT and VAT Credit, GST Input Tax Credit Time Limit, GST Refunds, GST Refund Rules, GST Input Tax Credit Rules

A Totally New Concept Of GST Learning through GST MasterClass Weekend Workshop – Training Program for Startups, Entrepreneurs & Professionals

GST MasterClass is a customized and hands-on training workshops for business owners, accountanOur GST MasterClass Training series offers a quick and hands-on training on GST laws, procedures and rules for individuals, freelancers, startups and professionals. GST MasterClass is a short-term practical training course of GST (Goods and Services Tax) for the student, job seeker and tax professionals in India.

GST MasterClass Weekend Workshop

GST Master-class is a customized and hands-on training workshops for business owners, accountants, lawyers, consultants, and students. Our GST Masterclass Training series offers a quick and hands-on training on GST laws, procedures and rules for individuals, freelancers, startups and professionals.

GST Masterclass is a short-term practical training course of GST (Goods and Services Tax) for the student, job seeker and tax professionals in India. Learn from experienced GST practitioners on up-to-date information on GST laws, procedures and rules.

Our program covers a wide range of topics such as GST Basics, Job Work, E-Commerce, Tax Invoice, GST Payments, GST Refunds, GST Compliances, GST Model Law Provisions, Debit and Credit Notes, GST Council, Settlement Commission & Advance Ruling.

HOW TO GET STARTED

Ideal for: Individuals, accountants, entrepreneurs, freelancers, lawyers & tax consultants

Duration: 1 Month ~ 4 Weekends ~ 16+ hours of practical learning

Learning approach

Methodology: 100% Practical & Do-It-Yourself Training

Benefits: Q&A Session, One-on-One Consulting

How to apply?

WhatsApp (no calls): 8700418920 to discuss your specific GST training program module.

Instructions for making payment through RazorPay :

Payment of VIRTUAL OFFICE – MODULE -1 ; Enrollment fee has to be pay through Razorpay facility using UPI , Wallets, Internet banking, Credit cards or Debit cards. Follow the Instructions given below for making your payments. Steps to be followed:

• Access PAY NOW or click the Image (Logo) of RazorPay or Caption mentioned below “CLICK TO PAY FOR MODULE 1

• Enter your email id & Phone Number and Pay through the available options.

• Take a screen shot and attach the same with your enrollment form or share the details of successful payment details via whatsapp.

COURSE OVERVIEW

Course Overview

The implementation of the Goods and Service Tax on July 1st 2017 has led to one of India’s greatest tax reforms of all time. GST is a comprehensive tax levied on the supply of goods and services that replaces all other indirect taxes such as central excise duty, state VAT, central sales tax, purchase tax, etc. So, whether you are a trader, manufacturer or a service provider, you need to register under GST to file returns.

If you’re wondering how to file GST returns or are thinking how many returns in GST you have to file, you can visit the GST login portal to find answers to all your queries and to file GST online. To start with, you should first know how to register for GST and how to get your GST number.

What is GST Return?

A GST Return is a document that mentions all details related to GST invoices, payments, and receipts for a specific period. A taxpayer is liable to declare all transactions related to the revenue of the business based on which the authorities will calculate the amount of tax to be paid by the business.

Business owners can file GST online on the official portal provided by GSTN.

While filing GST returns, the registered dealer requires the following details for the concerned period.

-

Total sales.

-

Total purchases.

-

Output GST (GST paid by customers.)

-

ITC or Input Tax Credit (GST paid by the business for purchases.

Once filed, a registered dealer can check GST Return filing status online and comply with necessary requirements accordingly.

In addition, you also need to understand and choose the right form before you initiate the GST return filing procedure. There are 11 types of returns applicable under the GST regime and each form has a different purpose and due date. For example, you will have to file GSTR-1 by the 10th of every month in case you are filing details of outward supplies of taxable goods. Once you have this information and know your GST number, choose the appropriate GST form and file GST online by the due date.

Types of GST Returns

The types of GST Returns filed by regular taxpayers include the following.

| S.No | Return | Particulars |

|---|---|---|

| 1. | GSTR 1 | Carries details of taxable goods or services, or both as well as that of outward supplies. |

| 2. | GSTR 2 | Carries details of inward supplies related to taxable goods and/or services, along with ITC claim. |

| 3. | GSTR 3 | Includes details of monthly returns based on finalised detail related to inward and outward supplies. It also includes details of total tax payable. |

| 4. | GSTR 4 | Carries details related to Quarterly Return filing, specifically for compounded tax liabilities of specific individuals. |

| 5. | GSTR 5 | Includes details of GST return filing for non-resident foreign individuals. |

| 6. | GSTR 6 | Serves as the form for Input Service Distributors to file returns. |

| 7. | GSTR 7 | Serves as the form facilitates Return filing for authorities initiating TDS. |

| 8. | GSTR 8 | Carries supply details for e-commerce operators along with the tax amount collected as per sub-section 52. |

| 9. | GSTR 9 | Serves as the form to file Annual Returns. |

| 10. | GSTR 9A | Includes details to file Annual Returns relative to Compounding taxable individuals registered u/s 10. |

10 Steps to File GST Return Online

-

1. Make sure that you are registered under GST and have the 15-digit GST identification number with you based on your state code and PAN. In case you do not have this number, first register online to get it.

-

2. Next, visit the GST portal.

-

3. Click on the ‘Services’ button.

-

4. Click on ‘Returns dashboard’ and then, from the drop-down menu, fill in the financial year and the return filing period.

-

5. Now select the return you want to file and click on ‘Prepare online’.

-

6. Enter all the required values including the amount and late fee, if applicable.

-

7. Once you have filled in all the details, click on ‘Save’ and you will see a success message displayed on your screen.

-

8. Now click on ‘Submit’ at the bottom of the page to file the return.

-

9. Once the status of your return changes to ‘Submitted’, scroll down and click on the ‘Payment of tax’ tile. Then, click on ‘Check balance’ to view cash and credit balance, so that you know these details before paying tax for respective minor heads. Next, to clear your liabilities, you need to mention the amount of credit you want to use from the credit already available. Then click on ‘Offset liability’ to make the payment. When a confirmation is displayed, click on ‘OK’.

-

10. Lastly, check the box against the declaration and select an authorised signatory from the drop-down list. Now click on ‘File form with DSC’ or ‘File form with EVC’ and then click on ‘Proceed’. Make the payment in the next step for your respective GST.

The GST network stores all the information on registered sellers and buyers. So, if you own a company that is engaged in the supply of goods and services, you will have to file 3 monthly returns and one annual return using the simple spreadsheet template.